haven't filed taxes in 5 years will i still get a stimulus check

We use cookies to give you the best possible experience on our website. Citizen or a permanent resident who.

How To Get A College Student Stimulus Check 2022

I havent received the 1st 2nd or 3rd.

. Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years. I have not worked for the last 3 years waiting on my. You can read more on penalties here.

Zariah94 You do not remember the jobs you worked at in what year --- 2019 or 2020. Government has just started disbursing the stimulus checks it promised to millions of Americans. As of yet though the bill has not passed so that could change but currently thats how the bill is written.

Failure to File Taxes. But if you filed your tax return 60 days after the due date or the extended due date then you might have a bigger penalty. Weve done the legwork so you dont have to.

I havent filed like for ten years - Answered by a verified Tax Professional. If you meet the following requirements you should still be able to receive a government-issued stimulus check as a Non-Filer. If your tax refund goes into your bank account via direct deposit it could take an additional five days for your bank to put the money in your.

Havent Filed Taxes in 5 Years If You Are Due a Refund. You are a US. Your penalty will now be the smaller of 135 or 100 of your total tax debt.

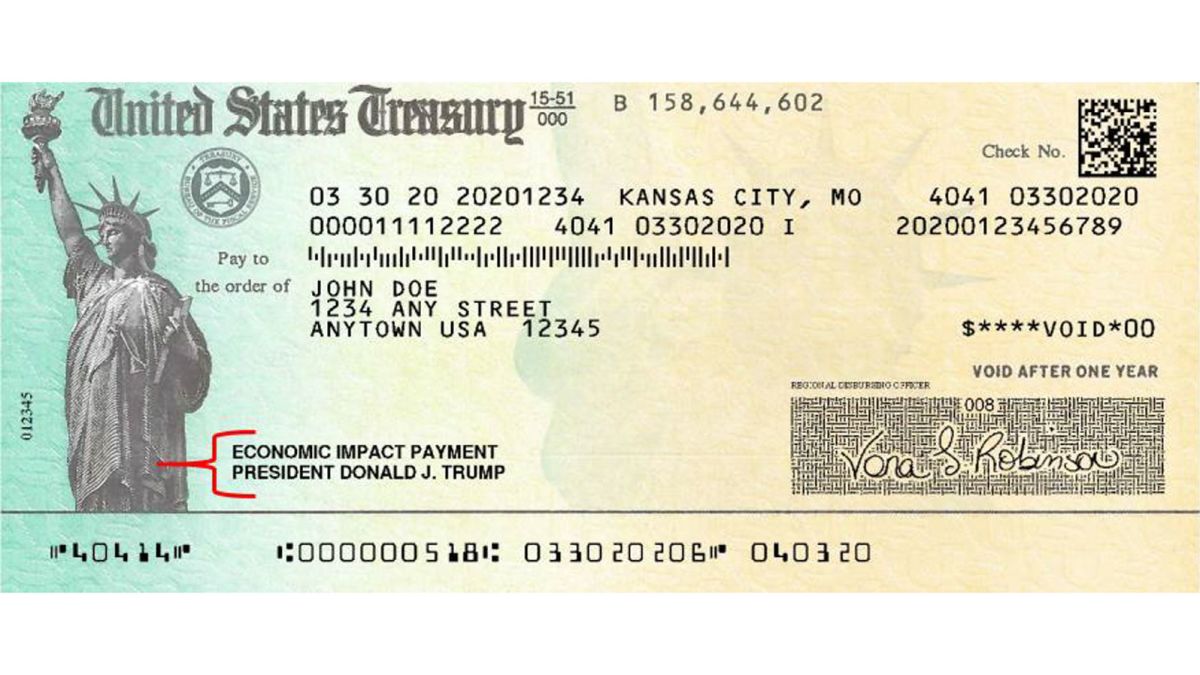

Under the Internal Revenue Code 7201 any willful attempt to evade. To get the 1200 Stimulus Check single 2400 married couple and 500 per child your 2018 or 2019 tax return will have to be filed UNLESS your only income is Social SecurityDisabilitySSI or at poverty level 12000 or less in which you will get the 1200 check without filing a return. If I havent filed taxes in 4 years and dont have any w2s or remember when or where I worked can you help me.

Confirm that the IRS is looking for only six years of returns. The penalty charge will not exceed 25 of your total taxes owed. If your return wasnt filed by the due date including extensions of time to file.

You may still be able to get a third stimulus check if you havent filed one. Havent filed taxes in 5 years will i still get a stimulus check Wednesday April 27 2022 Edit The agency has said it will continue to process stimulus checks throughout 2020 and to help people it has extended the deadline for people filing their 2019 income taxes from April 15 to. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them.

He said you could still be on the hook 10 or 20 years later. The IRS doesnt pay old refunds. Had gross income that did not exceed 12200 24400 for.

Thus you are legally entitled to the money if you meet the eligibility requirements. Failure to file or failure to pay tax could also be a crime. Enrolled Agent Paralegal.

This penalty is usually 5 of the unpaid taxes. If you dont file and pay taxes the IRS has no time limit on collecting taxes penalties and. They are giving stimulus checks to tax paying citizens.

Here are the tax services we trust. The IRS - who sends out the checks - will use your 2019 form to see how much money you should get. Httpsbitly3KUVoXuDid you miss the latest Ramsey Show episode.

For any year more than three years overdue you. If my taxes was rejected for 2018 2019 2020 will I still get a stimulus check. You can only claim refunds for returns filed within three years of the.

The government will calculate the amount of money you receive based on your adjusted gross income on your 2019 tax return. But this could mean youll receive less cash than youre entitled to in certain circumstances -. If you were due a refund and hadnt filed theres good news and some bad news.

They are gonna to base it off your 2018 or 2019 tax return. The failure to file penalty also known as the delinquency penalty runs at a severe rate of 5 up to a maximum rate of 25 per month or partial month of lateness. Questions still linger for many including whether they need to submit new information in order to get that money.

The deadline for claiming refunds on 2016 tax returns is April 15 2020. If You Owe Taxes. Its worth noting that the penalty for not filing your taxes is ten times the penalty for filing but failing to pay.

If I havent filed taxes in years will i still get a stimulus check. The IRS recognizes several crimes related to evading the assessment and payment of taxes. If you fail to file your tax returns on time you may be facing additional penalties and interest from the date your taxes were due.

I have not worked for the last 3 years waiting on my disiabilty will i still get a stimus check. The agency has said it will continue to process stimulus checks throughout 2020 and to help people it has extended the deadline for people filing their 2019 income taxes from April 15 to July 15. You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure to file timely.

If you havent turned in. If u havent filed for either year u will not be receiving a stimulus check. Its too late to claim your refund for returns due more than three years ago.

For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available on the IRSgov Forms and Publications page or by calling toll-free 800-TAX-FORM 800-829-3676. 1y NOT a tax pro - US You should prioritize filing 2019 ASAP since you can e-file that which only takes about 2 weeks to process. Tax not paid in full by the original due date of the return regardless of extensions of time to file may also result in the failure-to-pay.

Yes but you still must file your 2020 taxes. However you can still claim your refund for any returns from the past three years. Create a template for future compliance.

If you are asking about 2019 you might be able to get the employers names and some information by getting a 2019 wage and income transcript from the. The IRS has stated that it will not garnish stimulus check payments for back taxes. After May 17th you will lose the 2018 refund as the statute of limitations prevents refunds after three years.

Unless you go to a tax professional your 2018 tax return will need to be paper filed which takes 2 - 4 months. Dont let the IRS keep any more of your money.

There S One Last Chance To Get A Stimulus Check Here S How Silive Com

How To Get A Stimulus Check If You Don T File Taxes Updated For 2021

Irs Sends Another Batch Of 1 400 Stimulus Checks To 2m Americans

Third Stimulus Check Will It Be Based On 2019 Or 2020 Taxes Kare11 Com

Here S How To Get Your Stimulus Check By Direct Deposit Key Dates Deposit Tax Refund

When Will I Get My First Stimulus Check Get My Payment Il

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Verify 2019 And 2020 Tax Returns To Factor Into Stimulus Payouts Wusa9 Com

Can You Lose Stimulus Checks If You Don T File Taxes Before 2021 Deadline As Com

3rd Stimulus Check Tax Filing Impact The Child Tax Credit And Other Faqs Abc7 Chicago

How To Claim A Missing Stimulus Check

Did Your Income Drop In 2020 Here S How You Can Still Get Stimulus Checks

Stimulus Checks Still Waiting For Your Money Here S Why Cnn Politics

Checkmate Trump My Stimulus Check Odyssey Exberliner

Stimulus Check Update 2021 Final Round Of Payments Are You Eligible

If You Didn T Get A Stimulus Check Read This By Ben Hassan Medium

Stimulus Checks When You Ll Get Your Money And Why Some Will Have To Wait Longer Fox 59

Stimulus Check Never Arrived Irs Has Good News For You Oregonlive Com